The Ultimate Real Estate Due Diligence Checklist: 10 Critical Steps for 2025

Master your next property investment with our comprehensive real estate due diligence checklist. Secure, review, and sign documents faster and smarter.

Tired of nonsense pricing of DocuSign?

Start taking digital signatures with BoloSign and save money.

Investing in real estate is one of the most significant financial decisions you or your company will make. Whether you're a real estate agency acquiring a commercial property portfolio or a healthcare provider expanding with a new clinic, what happens between the offer and the closing table can make or break the deal. This crucial period, known as due diligence, is your non-negotiable opportunity to uncover hidden risks, verify seller claims, and ensure the property is a sound investment. A scattered approach with manual paperwork and endless email chains can lead to costly, irreversible oversights.

Imagine a better workflow. Picture a process where inspection reports, title commitments, and complex lease agreements are managed, reviewed, and approved digitally from a single, secure platform. This is where modern tools for contract automation and eSignatures transform the game, making comprehensive due diligence more manageable and secure than ever before. For example, a real estate firm can use BoloSign to create, send, and sign PDFs online, turning cumbersome paperwork into an instant, secure process. This comprehensive real estate due diligence checklist will guide you through the essential steps, showing you not only what to check but how to protect your investment and simplify your workflow. As you approach the closing phase, it's also vital to conduct a thorough final inspection before settlement to ensure the property meets all agreed-upon conditions, a final step that becomes much smoother with an organized, digital trail of documents.

1. Property Title and Ownership Verification

At the core of any real estate transaction is a simple question: does the seller legally own the property and have the right to sell it? Property title and ownership verification is the process of definitively answering this question. It involves a meticulous examination of the property's "chain of title," which is the complete historical record of ownership transfers, liens, and encumbrances. This step is non-negotiable in any serious real estate due diligence checklist because it protects you from inheriting costly legal battles, unforeseen debts, or even losing the property entirely after the purchase.

A professional title search, typically conducted by a title company or real estate attorney, uncovers critical issues that could derail a closing or create future liabilities. These professionals scour public records, including deeds, mortgages, court judgments, tax records, and divorce decrees, to ensure the title is "clear."

Common Red Flags Uncovered by a Title Search

- Outstanding Mortgages: An old mortgage that was never properly discharged can remain as a lien against the property.

- Easements and Covenants: Undisclosed easements can grant others the right to use parts of your property, restricting how you can develop or use the land.

- Boundary Disputes: Surveys linked to the title may reveal discrepancies between the legal description and the physical fences or structures on the ground.

- Mechanic's Liens: A contractor who performed work on the property but was never paid could have placed a lien against it.

Actionable Tips for Title Verification

- Engage Professionals Early: Hire a reputable title company or real estate attorney as soon as your purchase offer is accepted.

- Secure Title Insurance: Always purchase an owner's title insurance policy. This protects you from financial loss due to title defects discovered after you close.

- Review the Title Commitment: Before closing, you'll receive a title commitment report. Review every exception and requirement listed, asking your attorney to clarify anything you don’t understand.

Verifying title involves reviewing and signing numerous documents. Using an eSignature solution like BoloSign allows real estate agencies and professional services firms to securely create, send, and sign title commitments, disclosure forms, and purchase agreements. This accelerates the review process, ensuring all parties can approve critical title documents instantly without printing a single page.

2. Property Inspection and Condition Assessment

Beyond the legal paperwork, a property's physical health is a critical component of any real estate due diligence checklist. A property inspection and condition assessment is a thorough, top-to-bottom evaluation conducted by qualified professionals. It examines the structural integrity, mechanical systems (like HVAC, plumbing, and electrical), and the overall condition of the property to identify potential defects, deferred maintenance, and necessary repairs. This step is essential as it uncovers hidden issues that could translate into significant, unexpected costs and safety hazards post-purchase.

A comprehensive inspection report provides the buyer with powerful leverage. It details everything from minor cosmetic flaws to major structural deficiencies, giving a clear picture of the property's true state. This information is vital for making an informed decision, negotiating repairs or price adjustments with the seller, or even walking away from a problematic investment.

Common Red Flags Uncovered by a Property Inspection

- Structural Damage: Foundation cracks, water damage in crawl spaces, or evidence of termite infestation can signal costly structural problems.

- Roofing Issues: An inspector can identify the remaining lifespan of a roof, discovering issues like missing shingles or poor flashing that could lead to leaks.

- Outdated Systems: Faulty electrical wiring, an aging HVAC unit, or corroded plumbing can pose safety risks and require expensive upgrades.

- Mold and Moisture: The discovery of mold in a basement or attic often points to underlying moisture intrusion issues that need immediate remediation.

Actionable Tips for Property Inspection

- Hire Certified Professionals: Engage an inspector certified by a reputable organization like the American Society of Home Inspectors (ASHI) or the National Association of Home Inspectors (NAHI).

- Attend the Inspection: Be present during the inspection to see issues firsthand and ask the inspector questions.

- Request a Detailed Report: Ensure you receive a comprehensive written report complete with photos and clear explanations of any defects found.

- Negotiate Based on Findings: Use the inspection report as a tool to negotiate for repairs, a price reduction, or seller credits at closing.

Managing inspection reports, repair agreements, and addendums involves significant paperwork. A platform like BoloSign allows real estate professionals to handle these documents digitally. Agents can quickly send inspection response forms for an eSignature, creating a secure and auditable trail of all negotiations and agreements without the delays of printing and scanning.

3. Environmental Due Diligence and Phase I Assessment

Beyond the physical structure and legal title, the land itself can hold hidden liabilities that pose significant financial and legal risks. Environmental due diligence is the process of investigating a property to identify potential environmental contamination, hazardous materials, and regulatory non-compliance. This step is a critical component of any comprehensive real estate due diligence checklist, as it protects buyers from inheriting costly cleanup responsibilities and potential litigation that could far exceed the property's value.

The cornerstone of this process is the Phase I Environmental Site Assessment (ESA). Conducted by environmental professionals, a Phase I ESA involves reviewing historical records, government databases, and aerial photographs, as well as conducting a site inspection to identify "Recognized Environmental Conditions" (RECs). This assessment determines if past or present activities on or near the property, such as chemical storage or industrial use, could have led to contamination.

Common Red Flags Uncovered by an Environmental Assessment

- Underground Storage Tanks: Evidence of former gas stations or industrial facilities may indicate leaking underground tanks, which can contaminate soil and groundwater.

- Hazardous Building Materials: Older buildings may contain asbestos in insulation or lead-based paint, requiring expensive and highly regulated abatement procedures.

- Nearby Contaminant Sources: Proximity to landfills, dry cleaners, or manufacturing plants could result in migrating contamination onto the subject property.

- Historical Industrial Use: Records showing a property was once used for manufacturing, auto repair, or chemical processing are a major red flag for potential pollution.

Actionable Tips for Environmental Due Diligence

- Order a Phase I ESA Early: Initiate the Phase I ESA as soon as the property is under contract to allow ample time for review and potential follow-up (Phase II) testing.

- Verify ASTM Standards: Ensure the environmental consultant's report adheres to the latest ASTM E1527-21 standards to qualify for certain liability protections under federal law.

- Review Environmental Reports Thoroughly: Carefully analyze the findings of the ESA report with your legal counsel to understand all identified risks and recommendations.

- Prepare for Phase II if Necessary: If the Phase I report identifies RECs, be prepared to commission a Phase II assessment, which involves collecting and analyzing soil and water samples.

The environmental due diligence process generates extensive documentation. A logistics company acquiring a former industrial site can use BoloSign's AI contract review feature to quickly analyze lengthy assessment reports. The AI-powered tool flags key risks and liability clauses, ensuring informed decision-making without the manual bottleneck.

4. Financial Analysis and Appraisal Review

Beyond the legal and physical aspects, a property's financial viability is a crucial pillar of any real estate due diligence checklist. This stage involves a comprehensive evaluation of the property's valuation and its economic potential to ensure the purchase price is justified by both its market value and its ability to generate returns. It combines a formal appraisal with a detailed analysis of income, expenses, and market trends to prevent you from overpaying or acquiring an underperforming asset.

A third-party appraisal provides an unbiased, professional opinion of a property's fair market value, which is often a requirement for mortgage lenders. Simultaneously, your own financial analysis scrutinizes the property's historical performance and future projections. For an income-producing property like a rental or commercial building, this means verifying that its projected cash flow and return on investment align with your financial goals.

Common Red Flags Uncovered by Financial Analysis

- Appraisal-Price Discrepancy: An appraisal valuing the property significantly lower than your agreed-upon purchase price can jeopardize financing and indicate you are overpaying.

- Inflated Income Projections: A seller’s pro-forma may show idealized rental income and low vacancy rates that don’t match historical data or local market realities.

- Underestimated Operating Expenses: Sellers might omit or understate key costs like maintenance, property management fees, or upcoming capital expenditures, creating a misleading picture of profitability.

- Poor Market Comparables: An appraisal might use "comparable" properties that are not truly similar in location, size, or condition, resulting in a skewed valuation.

Actionable Tips for Financial Verification

- Obtain an Independent Appraisal: Commission an appraisal from a licensed professional early in the process, well before your loan commitment deadline.

- Scrutinize the Appraisal Report: Carefully review the appraiser’s methodology, the comparable sales (comps) used, and any adjustments made. Challenge the report if the data seems inaccurate.

- Analyze Historical Financials: Request and analyze at least 12-24 months of actual income and expense statements (known as a "rent roll" and "T-12" for commercial properties) to verify the seller's claims.

Financial due diligence requires the review and approval of numerous documents, from appraisal reports to profit and loss statements. Using a secure eSignature platform like BoloSign allows investors, lenders, and their advisors to securely manage and sign off on these critical financial documents. This accelerates the verification process, ensuring all stakeholders can approve reports and move the transaction forward efficiently.

5. Legal and Regulatory Compliance Review

Beyond clear title, a property's value and usability are fundamentally tied to its legal standing within the community. A legal and regulatory compliance review ensures the property's current and intended use adheres to all local, state, and federal laws. This crucial part of your real estate due diligence checklist involves examining zoning ordinances, building codes, permits, and any specific community or homeowners' association (HOA) rules. Neglecting this step can lead to fines, forced modifications, or the inability to use the property as planned.

This investigation confirms that the property isn't just legally owned, but also legally operable for your intended purpose. It protects you from purchasing a property with hidden limitations, such as a home with an unpermitted addition that you could be forced to tear down, or a commercial space where your business activities are prohibited. A thorough review safeguards your investment and prevents costly compliance battles with municipal authorities down the line.

Common Red Flags Uncovered by a Compliance Review

- Zoning Violations: Discovering a property marketed for commercial use is actually located in a strictly residential zone.

- Unpermitted Work: Identifying a finished basement or an added deck that was built without the required municipal permits and inspections.

- HOA Restrictions: Finding restrictive covenants that prohibit planned changes, such as building a fence or operating a home-based business.

- Outstanding Code Violations: Uncovering existing citations or fines from the city for issues like overgrown landscaping or improper waste disposal.

Actionable Tips for Compliance Verification

- Visit the Local Planning Department: Directly contact the local zoning and building departments to verify the property's designated use and pull permit history for all major improvements.

- Scrutinize HOA Documents: If applicable, obtain and meticulously review the HOA's bylaws, covenants, conditions, and restrictions (CC&Rs), and financial statements.

- Consult a Real Estate Attorney: For complex zoning issues or properties with a history of code violations, an attorney can provide expert interpretation and guidance.

Managing the various documents involved in this review, from HOA bylaws to permit applications, can be complex. Utilizing real estate contract management software helps centralize all compliance-related paperwork. A healthcare organization, for instance, can use BoloSign templates to create and send standardized compliance verification forms to local authorities, getting necessary approvals signed and returned digitally for faster, more organized record-keeping.

6. Financial Records and Operating Statements

For any income-producing property, the numbers must tell a truthful story. A comprehensive review of financial records and operating statements is the process of verifying that the property’s actual financial performance aligns with the seller's claims and your investment projections. This deep dive into the property's economic health is a critical part of any real estate due diligence checklist, as it exposes the reality behind the pro forma and protects you from acquiring an underperforming or money-losing asset.

This step involves scrutinizing several years of financial documents, including profit and loss statements, rent rolls, and expense records. A thorough financial audit, often performed by a real estate financial analyst or accountant, confirms the property's net operating income (NOI), identifies unsustainable expenses, and validates the potential for future cash flow. Overlooking this step is like buying a business without ever looking at its books, a recipe for financial disaster.

Common Red Flags Uncovered by Financial Review

- Undisclosed Expenses: Discovering significant recurring costs, such as major annual maintenance or high utility bills, that were not included in the seller's operating statements.

- Inflated Income: Finding that rental income is propped up by temporary concessions or includes non-recurring revenue sources that won't continue post-purchase.

- High Tenant Turnover: A rent roll analysis might reveal a history of high turnover and vacancy, leading to frequent and costly leasing commissions and make-ready expenses.

- Chronic Delinquencies: Identifying tenants who are consistently late with payments, signaling potential collection issues and unstable cash flow.

Actionable Tips for Financial Verification

- Request Historical Data: Obtain at least three years of complete, monthly profit and loss statements, rent rolls, and general ledgers.

- Verify, Don't Trust: Cross-reference the stated rental income with actual bank deposit statements and tenant lease agreements.

- Audit the Expenses: Reconcile claimed operating expenses with actual invoices and utility bills to ensure accuracy and uncover any hidden costs.

- Analyze Trends: Look for anomalies or significant year-over-year increases in specific expense categories that could indicate underlying property issues.

The financial review process involves handling sensitive documents like bank statements, leases, and vendor contracts. Using an eSignature solution like BoloSign allows sellers and property managers to securely share and certify financial records. This ensures that all documents are authentic and accounted for, creating a clear and auditable trail for your due diligence.

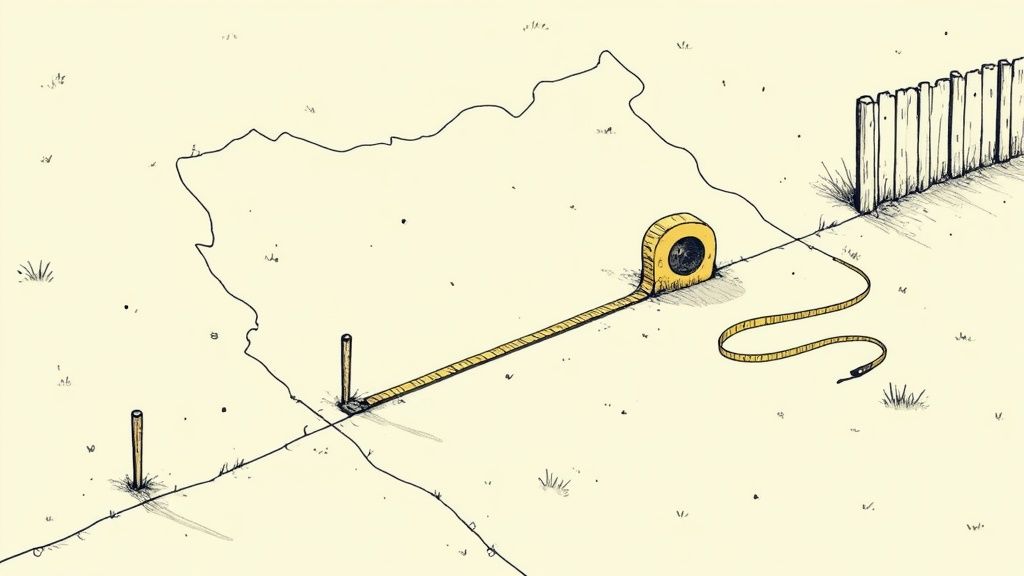

7. Survey and Boundary Verification

A property's legal description on paper can differ from its physical reality on the ground. Survey and boundary verification is the process of hiring a professional land surveyor to physically map the property, confirming its exact boundaries, dimensions, and the location of any improvements, easements, or encroachments. This step is a crucial part of any real estate due diligence checklist because it provides a definitive, legally defensible map of what you are actually buying, protecting you from future disputes with neighbors or legal challenges regarding land use.

A professional survey, often called an ALTA/NSPS Land Title Survey, is the gold standard. A licensed surveyor will research historical records, perform fieldwork with specialized equipment, and produce a detailed drawing that identifies the property lines and any features that could impact your ownership rights. This physical verification goes beyond what a title search can reveal, providing a clear picture of potential issues.

Common Red Flags Uncovered by a Property Survey

- Encroachments: A neighbor's fence, shed, or driveway may be built partially on the property you intend to buy.

- Undisclosed Easements: A survey can physically locate utility easements or access rights-of-way that were not obvious in the title report.

- Boundary Discrepancies: The survey might reveal that the property's actual size is smaller than advertised or that its boundaries don't match the legal description.

- Setback Violations: A building or structure on the property might have been built too close to the property line, violating local zoning ordinances.

Actionable Tips for Survey Verification

- Order the Survey Early: A full survey can take several weeks, so commission it as soon as you are under contract to avoid closing delays.

- Hire a Licensed Professional: Ensure your surveyor is licensed and certified in the state where the property is located, like those affiliated with the National Society of Professional Surveyors (NSPS).

- Review the Survey with Your Attorney and Title Company: Compare the survey map against the title commitment to identify any discrepancies or exceptions that need to be resolved or added to your title insurance policy.

Once the survey is complete, the surveyor’s report and certification must be reviewed and acknowledged. An eSignature solution like BoloSign allows developers and legal teams to securely send the survey documents for review and obtain a digital signature, creating a clear audit trail of who approved the findings and when. This ensures that any boundary issues are formally acknowledged before closing.

8. Insurance and Risk Assessment

A crucial, yet often overlooked, component of a real estate due diligence checklist is a thorough insurance and risk assessment. This step moves beyond the physical condition of the property to evaluate its insurability and the potential financial risks associated with owning it. It involves analyzing the property's claims history, understanding its location-specific hazards like floods or wildfires, and obtaining concrete insurance quotes. This process is essential because high insurance premiums or an inability to secure adequate coverage can severely impact your holding costs and overall return on investment.

A comprehensive risk assessment protects you from post-purchase financial shocks. Properties in designated flood zones, older buildings with outdated systems, or those in high-crime areas can carry surprisingly high premiums or require multiple, expensive policies. Ignoring this step means you could be acquiring an asset that is either uninsurable or so costly to insure that it drains your operational budget, turning a promising investment into a financial liability.

Common Red Flags Uncovered by an Insurance Assessment

- High-Risk Zone Designation: A property located in a FEMA-designated flood zone, a high-fire-risk area, or a coastal hurricane zone will command significantly higher insurance costs.

- Extensive Claims History: A long history of claims for issues like water damage, theft, or structural failures signals underlying problems and makes insurers hesitant to offer favorable terms.

- Outdated Infrastructure: Properties with old electrical wiring (e.g., knob-and-tube), aging plumbing, or a deteriorating roof may be difficult or impossible to insure with standard carriers.

- Coverage Gaps: Standard policies may exclude critical risks specific to the property, such as sinkholes, earthquakes, or mold, leaving you exposed to catastrophic losses.

Actionable Tips for Insurance and Risk Assessment

- Obtain Quotes Immediately: Don't wait until the last minute. Contact multiple insurance brokers as soon as you are under contract to get accurate quotes and understand coverage options.

- Request a CLUE Report: Ask the seller for a Comprehensive Loss Underwriting Exchange (CLUE) report, which details the property's insurance claims history over the past seven years.

- Verify Hazard Zones: Use official resources like the FEMA Flood Map Service Center to independently verify if the property is in a designated flood, fire, or other hazard zone.

During the assessment, you will review insurance binders, quotes, and disclosure forms. Using an eSignature solution like BoloSign streamlines this process by allowing you to receive, review, and digitally sign these documents from anywhere. This ensures you can lock in favorable insurance terms quickly and keep your closing on track without delays.

9. Tenant and Lease Analysis

For income-producing properties, the tenants are the engine of your investment. A thorough tenant and lease analysis is the process of examining the quality, stability, and profitability of the existing rental income stream. It involves a deep dive into each lease agreement, the financial health of the tenants, their payment history, and the overall terms that govern their occupancy. This step is a cornerstone of any commercial real estate due diligence checklist because it directly validates the property's financial performance and uncovers risks that could jeopardize your future cash flow.

A comprehensive analysis moves beyond simply looking at the stated monthly rent. It scrutinizes the terms of each contract, assesses the creditworthiness of tenants, and compares the current rental income against market potential. This evaluation helps you understand if the property is generating its maximum possible revenue or if there are hidden liabilities, like a high-risk tenant on the verge of default.

Common Red Flags Uncovered by Tenant and Lease Analysis

- Below-Market Rents: A lease review might reveal that a long-term tenant is paying significantly less than the current market rate, limiting the property's immediate income potential.

- Frequent Late Payments: A pattern of arrears or consistently late payments is a major indicator of tenant financial instability and a potential future eviction.

- High Tenant Turnover: A history of short-term leases or frequent vacancies could signal issues with the property, management, or location.

- Undisclosed Lease Concessions: The seller may have offered free rent or other concessions that are not immediately apparent on the rent roll, artificially inflating the property's income figures.

Actionable Tips for Tenant and Lease Analysis

- Obtain All Lease Documentation: Request and meticulously review a copy of every active lease agreement, including any amendments, addendums, or guarantees.

- Verify Payment Histories: Ask for a certified rent roll and at least 12-24 months of payment history for each tenant to identify any patterns of delinquency.

- Assess Tenant Financial Health: With proper consent, run credit and background checks on key commercial tenants to evaluate their financial stability and ability to meet future obligations.

- Benchmark Against the Market: Conduct a comparative market analysis to see how the property's current rental rates stack up against similar properties in the area.

Analyzing and managing multiple lease agreements requires a secure and efficient system. For real estate professionals, an essential part of this process involves digital lease signing and management, which helps centralize documents, track renewal dates, and execute new agreements quickly. This ensures that all tenant-related contracts are organized and legally sound from day one of your ownership.

10. Title Insurance and Lender Requirements

While a title search identifies potential ownership issues, title insurance provides the financial protection against them. This crucial insurance policy safeguards you and your lender from financial loss due to title defects, liens, or other encumbrances that were missed during the initial title search. Understanding and securing the right policy is a cornerstone of any comprehensive real estate due diligence checklist, as it acts as a final, critical layer of defense against unforeseen ownership claims that could emerge years after closing.

Lenders will always mandate a loan policy to protect their investment, but it's equally important for you, the buyer, to obtain an owner's policy to protect your equity. This step involves a careful review of the title commitment, which outlines the terms, conditions, and exceptions of the proposed insurance policy. It's your opportunity to ensure the coverage is adequate and that any exceptions, such as a known utility easement, are acceptable to you and will not hinder your intended use of the property.

Common Red Flags in Title Insurance and Lender Requirements

- Excessive or Vague Exceptions: A title commitment loaded with broad exceptions (e.g., "any and all matters not of public record") can significantly weaken your protection.

- Unaddressed Lender Mandates: Failing to meet a specific lender requirement, like obtaining a particular ALTA endorsement for encroachment protection, can delay or even halt the closing process.

- High Premiums: While rates are often regulated, costs can vary. Not comparing quotes can lead to overpaying for the same level of coverage.

- Unresolved Title Objections: Proceeding to closing without formally resolving or negotiating the removal of problematic exceptions identified in the title search.

Actionable Tips for Title Insurance

- Obtain the Title Commitment Early: Request the title commitment from the title company as soon as it's available. This gives you and your attorney ample time to review it.

- Request a Detailed Explanation: Have your real estate attorney or title agent walk you through every exception listed. Do not close until you understand the implications of each one.

- Negotiate Problematic Exceptions: If an unacceptable exception appears, such as an old lien that should have been removed, work with the seller and title company to have it cleared before closing.

- Consider Extended Coverage: For added protection against issues like unrecorded mechanic's liens or boundary disputes, inquire about an ALTA (American Land Title Association) extended coverage policy.

Managing the back-and-forth of title commitments and lender requirement documents involves multiple reviews and approvals. A complete real estate transaction checklist should include a streamlined process for these documents. Using a platform like BoloSign, real estate professionals can securely send the title commitment to all parties for electronic review and signature, ensuring all lender stipulations and policy terms are acknowledged and approved efficiently.

10-Point Real Estate Due Diligence Comparison

| Item | 🔄 Implementation complexity | ⚡ Resource requirements | 📊 Expected outcomes | 💡 Ideal use cases | ⭐ Key advantages |

|---|---|---|---|---|---|

| Property Title and Ownership Verification | Moderate — legal review & record searches | Title company, attorney time; moderate cost | Clear ownership; liens and encumbrances identified | All purchases, high‑value or disputed titles | ⭐ Strong legal protection; reduces acquisition risk |

| Property Inspection and Condition Assessment | Low–moderate — physical inspections & specialist tests | Certified inspectors, specialty contractors; $300–$800 typical | Reveals defects; repair scopes and cost estimates | Residential buys, older homes, safety concerns | ⭐ Prevents costly post‑purchase surprises |

| Environmental Due Diligence and Phase I Assessment | Moderate — historical review & site reconnaissance | Environmental consultant; Phase I $1,500–$3,500 | Identifies contamination risks and regulatory liabilities | Commercial/industrial sites; lender/investor requirements | ⭐ Protects against environmental liability exposure |

| Financial Analysis and Appraisal Review | Low–moderate — appraisal and financial modeling | Appraiser, financial analyst; appraisal $400–$600 | Validated market value, ROI and cash‑flow projections | Investment properties, financing, valuation checks | ⭐ Prevents overpayment; supports negotiation |

| Legal and Regulatory Compliance Review | Moderate — zoning, permits, code checks | Real estate attorney, planner; agency coordination | Confirms permitted uses and code compliance | Development, change of use, permit‑sensitive buys | ⭐ Avoids violations and operational restrictions |

| Financial Records and Operating Statements | Moderate — accounting review and reconciliation | Accountant/analyst; access to leases and statements | Verifies income, expenses, and true cash flow | Income‑producing assets and portfolio acquisitions | ⭐ Ensures accurate proforma and risk visibility |

| Survey and Boundary Verification | Low–moderate — field survey and mapping | Licensed surveyor (PLS); $400–$1,500+ depending on site | Confirms boundaries; detects easements/encroachments | Land acquisitions, additions, construction planning | ⭐ Prevents boundary disputes; clarifies site limits |

| Insurance and Risk Assessment | Low — coverage review and risk assessment | Insurance broker/underwriter; claims history review | Estimates premiums, coverage gaps, insurability | Properties in hazard zones or older assets | ⭐ Clarifies total cost of ownership and coverage gaps |

| Tenant and Lease Analysis | Moderate — lease review and tenant vetting | Property manager, credit/background checks; tenant data | Assesses rent stability, lease risks and renewal prospects | Multi‑tenant rentals, commercial leases, income assets | ⭐ Validates income stream; exposes tenant risks |

| Title Insurance and Lender Requirements | Low–moderate — policy review & lender coordination | Title insurer, lender conditions; premiums $1,500–$3,000 | Lender compliance achieved; title risk transfer | Mortgaged purchases and lender‑financed transactions | ⭐ Transfers title risk; typically required for financing |

Streamline Your Due Diligence with AI-Powered Contract Automation

Completing a comprehensive real estate due diligence checklist is the cornerstone of any successful property transaction. As we've detailed, the process is a meticulous journey through property titles, physical inspections, financial audits, and complex regulatory landscapes. From verifying ownership and assessing environmental risks to scrutinizing tenant leases and securing adequate insurance, each step is designed to mitigate risk and uncover the true value of an asset. Ignoring any single item on this checklist, whether it's an unverified survey or an overlooked clause in a lease agreement, can lead to costly surprises and derail a promising investment.

The true challenge, however, isn't just knowing what to check; it's managing the overwhelming volume of documents, approvals, and communications that come with it. Each step generates reports, contracts, addendums, and disclosures that must be reviewed, shared, and signed by multiple stakeholders-buyers, sellers, agents, attorneys, inspectors, and lenders. This is where traditional, manual processes break down, creating bottlenecks, introducing human error, and jeopardizing tight closing deadlines.

Transforming Your Checklist into Action with BoloSign

The future of efficient due diligence lies in leveraging technology to automate and secure this critical workflow. Instead of juggling endless email chains, printing and scanning documents, and chasing physical signatures, you can centralize your entire process on a single, intelligent platform. This is precisely where BoloSign transforms your real estate due diligence checklist from a static guide into a dynamic, streamlined operation.

Imagine this workflow:

- Instant Document Generation: Your team can instantly create all necessary documents-from purchase agreements and inspection contingency forms to lease abstracts-using pre-approved, branded templates. This ensures consistency and compliance across every transaction.

- AI-Powered Review: Our AI contract review tools can help you quickly analyze complex legal documents, flagging critical clauses, identifying potential risks, and ensuring all terms align with your objectives. This accelerates the legal review phase without sacrificing precision.

- Secure and Compliant eSignatures: Send documents for digital signing to all parties simultaneously. With BoloSign, you can securely sign PDFs online, knowing that every signature is compliant with global standards like ESIGN, eIDAS, HIPAA, and GDPR, providing a legally binding and auditable trail.

This shift from manual to automated isn't just about speed; it's about control, security, and scalability. For real estate agencies, property developers, and legal teams in the US, Canada, Australia, and the UAE, this means closing deals faster, reducing administrative overhead, and providing a superior client experience. Most importantly, it empowers you to focus on strategic decision-making rather than getting lost in paperwork.

The true power of a real estate due diligence checklist is only realized when it's executed flawlessly. By integrating a solution like BoloSign, you equip your team with the tools to manage every document, track every approval, and secure every signature with unparalleled efficiency. The best part? BoloSign offers unlimited documents, templates, and team members for one fixed price, making it up to 90% more affordable than platforms like DocuSign or PandaDoc. You get enterprise-grade features without the enterprise-level cost, making it the perfect fit for growing firms and established enterprises alike. Don't let an outdated process undermine your next major investment.

Ready to revolutionize your real estate transactions? Experience how BoloSign can automate your due diligence workflow, accelerate closing times, and cut costs with its all-in-one contract automation platform. Start your 7-day free trial today and see the difference firsthand.

Paresh Deshmukh

Co-Founder, BoloForms

13 Dec, 2025

Take a Look at Our Featured Articles

These articles will guide you on how to simplify office work, boost your efficiency, and concentrate on expanding your business.

Compare the best AI contract review tools for 2025. See features, benefits, and practical tips to implement them at scale. Explore BoloSign’s unified solution.

Paresh Deshmukh

Co-Founder, BoloSign

Learn if clickwrap agreements are legally binding, how they work, and key best practices for enforceability.

Paresh Deshmukh

Co-Founder, BoloSign

Ready to streamline your contract management with AI?

Contact Sales

AI assistant to draft, review, and eSign contracts on autopilot for fastest growing companies.

Email: support@boloforms.com

Sales Inquiry

AI assistant to draft, review, and eSign contracts on autopilot for fastest growing companies.

Email: support@boloforms.com

Company

Solutions

Resources

Legal & Security

Sales Inquiry