What Is Contract Compliance and How Does It Protect Your Business?

Confused about what is contract compliance? Discover how it protects your business from risk and learn actionable steps to manage it with AI-powered tools.

Tired of nonsense pricing of DocuSign?

Start taking digital signatures with BoloSign and save money.

At its heart, contract compliance is simple: it’s the process of making sure everyone involved in an agreement actually does what they promised to do. It covers everything from hitting deadlines and making payments on time to following specific industry rules.

What is Contract Compliance, Really?

Think of a contract as the blueprint for a business relationship. Contract compliance is the quality control that happens during construction, ensuring the final result is built exactly to spec. It means you’re actively monitoring, managing, and documenting how well everyone is sticking to the terms.

This isn’t just about dodging legal bullets. It’s a core business function that directly impacts your bottom line, keeps operations running smoothly, and protects your reputation. When you nail compliance, projects get done, money flows correctly, and your relationships with clients and partners stay strong.

The Four Pillars of Contract Compliance

To really get a handle on contract compliance, it helps to see how it fits into bigger frameworks like Governance, Risk, and Compliance (GRC) principles. A solid compliance strategy is built on four essential pillars that work together to protect your business.

Here’s a simple breakdown of what those pillars are and why they're so important.

| Pillar | What It Covers | Why It Matters |

|---|---|---|

| 1. Obligation Management | Tracking and fulfilling all the specific deliverables, deadlines, and duties written into the contract. | This is the "get it done" part. Failing here leads to broken promises, missed revenue, and damaged relationships. |

| 2. Regulatory Adherence | Ensuring the contract and its execution follow all relevant local, national, and international laws (e.g., HIPAA, GDPR, eIDAS). | Avoids massive fines, legal battles, and reputational damage. It keeps your business on the right side of the law. |

| 3. Financial Governance | Managing everything from accurate invoicing and timely payments to applying correct discounts and avoiding penalties. | This pillar protects your cash flow and profitability. Errors here can quietly drain your bottom line. |

| 4. Documentation & Reporting | Keeping a clear, accessible record of all contract activities, communications, and changes for audits or disputes. | When something goes wrong, this is your proof. A solid audit trail can save you from a world of hurt. |

Ultimately, these four pillars ensure that every contract you sign delivers the value you expect while minimizing unnecessary risk.

A strong compliance framework moves a business from a reactive "firefighting" mode to a proactive state where risks are identified and mitigated before they become costly problems. It's about control and predictability.

Trying to manage all this with spreadsheets and email is a recipe for disaster. Manual methods are slow, prone to human error, and offer zero real-time visibility. This is where modern digital signing solutions become essential.

Platforms like BoloSign provide the tools to build a robust compliance foundation from day one. By using compliant templates, you can sign PDFs online with legally binding eSignatures that create an unbreakable audit trail. Smart tools for AI contract review can automatically flag non-standard clauses or potential risks, making sure your agreements are solid before they even go out. Centralizing everything in one secure hub turns monitoring obligations and preparing for audits into a simple, streamlined process instead of a frantic last-minute scramble.

The True Cost of Non-Compliance

Ignoring contract compliance is like ignoring a small leak in your roof. At first, it seems like a minor drip you can deal with later. But over time, that drip causes widespread damage that’s far more expensive to fix than the initial problem ever was.

Getting compliance wrong isn't just a minor administrative slip-up; it's a direct and often painful hit to your finances, reputation, and operational stability. The consequences move beyond abstract legal warnings and into tangible, everyday business realities. These aren't just one-off events but slow, persistent drains on your resources that can cripple growth and erode the trust you've built with partners and clients.

Financial Penalties and Revenue Leakage

One of the most immediate and gut-wrenching impacts of non-compliance is direct financial loss. This shows up in several painful ways, turning what should be profitable agreements into costly liabilities. It's a silent profit killer that many businesses don't even realize is happening until it's too late.

Common ways money walks out the door include:

- Direct Fines and Penalties: Plenty of contracts have clauses for late deliveries, missed service-level agreements (SLAs), or failure to meet quality standards. A logistics company, for example, could face escalating fines for every single shipment that arrives behind schedule.

- Revenue Leakage: This is the money you leave on the table by failing to enforce your own contractual rights. Think of missed opportunities for price increases, unapplied late fees you were entitled to, or unclaimed volume discounts.

- Wasted Spend: On the flip side, you might be overpaying vendors because no one is holding them to their contracted pricing or service levels. This is especially common in procurement, where a lack of oversight means you end up paying for services you're not fully receiving.

These hits are only getting bigger as poor data governance adds to the cost. The 2025 State of Contracting analysis by Icertis revealed that a staggering 90% of CEOs and 82% of CFOs believe their companies are under-monetizing their contracts. At the same time, data breaches linked to non-compliance cost about $174,000 more per incident, with the average breach now hitting $4.61 million. You can dig into the full report to see just how deep the rabbit hole goes.

Reputational Damage and Lost Opportunities

The financial costs are just one piece of the puzzle. What's often more damaging in the long run is the erosion of your company's reputation. Every missed deadline, every unfulfilled promise—it all chips away at the trust you’ve worked so hard to build.

In business, your reputation is your most valuable asset. Non-compliance is a fast track to damaging it, often permanently. A single high-profile failure can undo years of hard work.

In a competitive market, clients have plenty of choices. A staffing agency that fails to provide properly vetted candidates risks not just losing one contract but being blacklisted by an entire industry. Similarly, a healthcare provider that mishandles patient data faces not only HIPAA fines but also a public relations crisis that drives patients away. This reputational harm leads directly to lost business and makes it significantly harder to win new contracts.

Operational Disruption and Legal Exposure

Poor compliance creates internal chaos. When teams don't have a clear, centralized view of their contractual obligations, they operate in silos. This leads to duplicated work, missed handoffs, and frustrating project delays, grinding productivity to a halt.

Worse yet, it swings the door wide open for serious legal trouble. A poorly managed contract is just a dispute waiting to happen. Without a clear audit trail from a robust digital signing solution like BoloSign, proving your case becomes nearly impossible. Every electronically signed document in BoloSign creates a legally binding, time-stamped record, ensuring you have the evidence to defend your position if a disagreement arises.

Using a platform that streamlines contract automation and provides AI-powered intelligence isn't just about efficiency—it's about building a fortress of proof around every agreement you make.

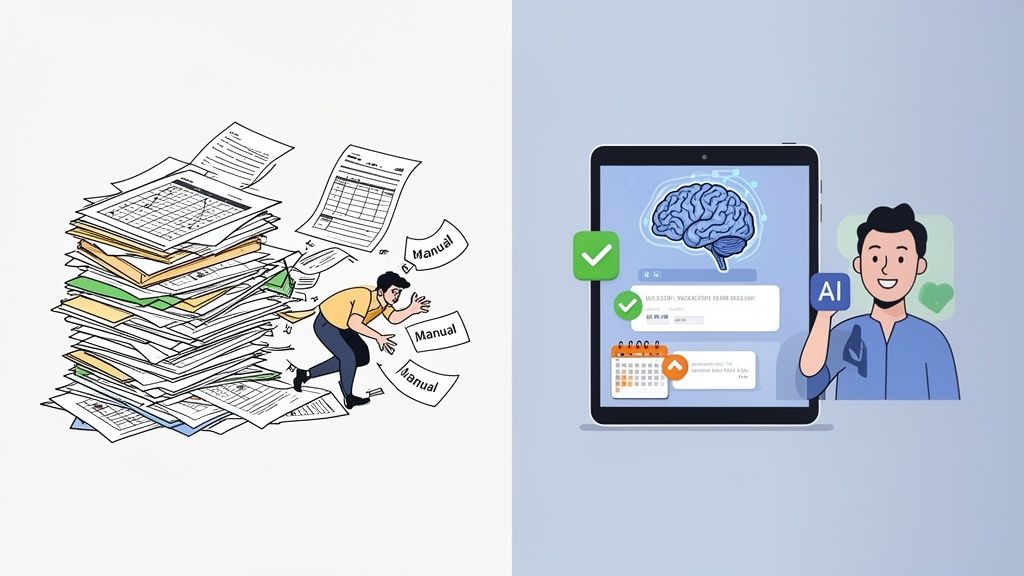

From Manual Checklists to AI-Powered Automation

Not long ago, managing contract compliance was a physical, painstaking chore. It meant digging through towering filing cabinets, deciphering cryptic spreadsheets, and chasing approvals through endless email chains. This manual approach wasn't just inefficient; it was a breeding ground for risk.

Imagine a busy professional services firm trying to track hundreds of client agreements on an Excel sheet. Each row represents a critical obligation—project milestones, payment schedules, and confidentiality clauses. A single typo or a missed deadline could mean a breach of contract, triggering serious financial and reputational penalties.

This old way of working was defined by a complete lack of visibility. Contracts were just static documents, locked away until a problem blew up. Monitoring was a reactive, backward-looking exercise, making it impossible to scale without multiplying risk.

The Pitfalls of Manual Compliance

Relying on manual checklists and disconnected systems created predictable but damaging failure points. These issues weren't minor inconveniences; they were fundamental cracks in a company's operational foundation.

Key problems included:

- Zero Real-Time Visibility: You could never be sure you were looking at the most current version of an agreement or its status. Decisions were constantly being made with outdated information.

- High Risk of Human Error: Manual data entry is inherently prone to mistakes. A missed renewal date or an incorrect payment term could easily cost thousands.

- Impossible to Scale: As a business grows, so does the volume and complexity of its contracts. A manual system that works for 10 contracts will completely collapse under the weight of 100 or 1,000.

In the manual era, contract compliance was an administrative burden—a box-ticking exercise performed after the fact. Today, technology has transformed it into a proactive, strategic function that drives business intelligence and mitigates risk in real time.

The Shift to Proactive, Data-Driven Monitoring

The evolution of contract compliance mirrors the broader digital shift in business. It has moved from a narrow legal checkpoint to a dynamic, data-driven discipline. Historically, a shocking percentage of agreements were signed and forgotten. In the early 2000s, it was estimated that up to 80% of executed contracts were never systematically monitored for compliance.

Contrast that with today's landscape. A-LIGN’s 2025 Compliance Benchmark Report notes that 92% of organizations now conduct at least two audits or assessments annually, with 58% conducting four or more. This dramatic shift highlights a growing recognition that active monitoring isn't optional—it's essential.

The Rise of AI-Powered Contract Intelligence

This transition was made possible by intelligent contract automation platforms. These systems didn't just digitize the filing cabinet; they introduced a new layer of intelligence that turned static documents into active, manageable assets. This is where the power of artificial intelligence in contract management truly becomes a game-changer.

AI-powered platforms like BoloSign automate the entire lifecycle, from creation to renewal. Instead of someone manually scanning for risky clauses, an AI assistant can perform an AI contract review in seconds, flagging non-standard terms and suggesting compliant alternatives.

For a professional services firm, this means instantly verifying that every new client agreement includes the correct liability clauses and payment schedules. For a real estate agency, it means automating reminders for inspection deadlines and financing contingencies across dozens of active deals.

With BoloSign, organizations can instantly create, send, and sign PDFs and templates, all while embedding compliance directly into the workflow. The system creates an unchangeable audit trail for every single action, from the initial draft to the final eSignature. This turns compliance from a manual, error-prone checklist into an automated, reliable, and scalable business process.

How Contract Compliance Works Across Industries

Contract compliance isn't a one-size-fits-all game. The rules, risks, and stakes change dramatically from one industry to the next. What counts as a critical failure in healthcare might be a minor hiccup in logistics, and understanding these nuances is the key to managing risk without slowing down your business.

Every sector has its own set of high-stakes obligations, regulatory minefields, and operational deadlines. One small misstep can set off a chain reaction of financial penalties, operational chaos, and a damaged reputation. Let’s look at how this plays out in the real world across a few key industries.

Healthcare: Patient Data and HIPAA

In healthcare, contract compliance is all about patient safety and data privacy. The Health Insurance Portability and Accountability Act (HIPAA) sets ironclad federal standards for protecting sensitive patient health information (PHI). This isn't just a suggestion; it's the law.

Every Business Associate Agreement (BAA) a clinic signs with a vendor—whether it's for billing services or a new software tool—has to include specific clauses that guarantee HIPAA adherence. A failure here isn’t just a simple contract breach; it's a potential data leak with devastating consequences.

Picture a clinic that starts using a third-party scheduling app. If that app's contract doesn't meet HIPAA's strict security standards and patient data gets exposed, the clinic is on the hook for:

- Massive Fines: Penalties can skyrocket to $1.5 million per year for each violation.

- Reputational Ruin: Patients lose trust overnight, and the clinic's credibility is shattered.

- Corrective Action Plans: Federal regulators can impose costly, long-term oversight that drains resources.

For any healthcare provider, using a secure digital signing solution like BoloSign is non-negotiable. Our platform was built with HIPAA compliance at its core, ensuring every BAA, patient consent form, and vendor agreement is executed with an unbreakable, time-stamped audit trail. To dig deeper, check out our guide on contract management software for healthcare. This is how you protect both your practice and your patients.

Staffing: Onboarding and Vetting

For staffing and HR agencies, compliance revolves around people and the paperwork that follows them. Client contracts often demand specific background checks, certifications, and onboarding steps for every single candidate placed. Dropping the ball means putting an unvetted or unqualified person in a role, creating a massive liability for both the agency and the client.

Think about an agency that supplies temporary IT staff to a major bank. The client's contract requires a comprehensive criminal background check and specific cybersecurity certifications. If the agency cuts corners and places someone without the right credentials, it could lead to a security breach, costing the bank millions and destroying the agency's reputation for good.

Logistics: Delivery Timelines and SLAs

In the fast-paced world of logistics and transportation, time is literally money, and compliance is measured in minutes. Contracts are built around rigid Service Level Agreements (SLAs) that dictate precise delivery windows, special handling procedures for fragile goods, and proof of insurance.

A single late delivery might just trigger a financial penalty, but a pattern of non-compliance can get a contract terminated. For example, a third-party logistics (3PL) provider for an e-commerce giant might have to meet a 99.5% on-time delivery rate. Falling short doesn't just mean fines for each missed deadline—it puts a multi-million dollar relationship at risk.

In high-volume, low-margin industries like logistics, consistent SLA compliance isn't a goal—it's the only way to stay profitable and competitive.

Real Estate: Deadlines and Contingencies

Real estate deals are a complex dance of deadlines and contingencies. Purchase agreements are packed with critical dates for inspections, mortgage approvals, and closings. Missing just one of these can cause the whole deal to fall apart, leading to lost commissions and angry clients.

For a busy real estate agency, manually juggling dozens of active deals is a recipe for disaster. An agent who forgets to remind their client about an expiring inspection contingency could force the buyer to either accept a property with hidden problems or lose their earnest money deposit.

The common thread across all these industries is the desperate need for visibility and control. Trying to track these diverse and critical obligations with spreadsheets is just asking for something to slip through the cracks. This is exactly why platforms that provide powerful contract automation are becoming so essential.

With BoloSign, you can instantly create, send, and sign PDFs online using templates customized for your industry's specific compliance needs. Automated reminders make sure no deadline is ever missed, and a central dashboard gives you a clear view of all your contractual promises. And because BoloSign offers unlimited documents and team members for one fixed price—up to 90% more affordable than competitors like DocuSign—enterprise-grade compliance is finally within reach for any business.

Navigating the Complexities of Global Regulations

Once your business crosses borders, your contracts are no longer governed by a single set of rules. Suddenly, they're subject to a tangled web of international laws that can vary dramatically from one country to the next. This creates a massive headache for any business trying to keep its agreements compliant across multiple jurisdictions.

Imagine a single master services agreement that needs to satisfy the EU's General Data Protection Regulation (GDPR), California's Consumer Privacy Act (CCPA), and Canada's Personal Information Protection and Electronic Documents Act (PIPEDA) all at once. Trying to juggle these overlapping—and sometimes conflicting—regulations with spreadsheets and manual checklists is a recipe for disaster.

The Growing Web of Global Rules

And this challenge is only getting bigger. The rapid expansion of global regulations has turned contract compliance into a major cross-border governance issue. By early 2025, a staggering 144 countries had enacted data protection or consumer privacy laws, covering an estimated 79–82% of the world’s population.

It’s no surprise, then, that a recent PwC survey found nearly 90% of organizations say their compliance duties have shot up significantly. Cybersecurity and data protection now rank as top-five risks for over half of all firms. You can discover more insights about this expanding regulatory landscape on concord.app.

In this environment, manually tracking requirements just isn't a viable risk management strategy anymore. For businesses in highly regulated sectors like healthcare, for example, it's absolutely critical to ensure your solutions are built on platforms that are HIPAA compliant.

Creating a Single Source of Truth

This is where a centralized, intelligent system becomes non-negotiable. To operate confidently on the world stage, you need a single source of truth that can map contractual clauses to specific legal requirements and provide a clear, indisputable audit trail.

Modern digital signing solutions are designed to meet this challenge head-on. They provide the framework you need to manage agreements that must comply with multiple international eSignature standards, such as:

- ESIGN Act (U.S.): Ensures electronic signatures are legally equivalent to handwritten ones across the United States.

- eIDAS (EU): Provides a consistent legal framework for electronic identification and trust services across the entire European Union.

A platform like BoloSign centralizes your entire contract portfolio, giving you the visibility and control needed to navigate this complex terrain. With AI-powered tools, you can automate the process of checking agreements against specific regulatory frameworks, making sure every document is compliant before it gets signed.

When your business crosses borders, your compliance strategy must too. A centralized platform transforms a chaotic mess of global rules into a manageable, transparent, and auditable process.

Instead of hiring legal experts in every country you operate in, you can use a system that builds global compliance knowledge directly into your workflow. BoloSign helps you sign PDFs online with the assurance that your agreements meet stringent international standards for security and legal validity.

By offering unlimited documents, templates, and team members at one fixed price, BoloSign makes this level of sophisticated compliance accessible. It's up to 90% more affordable than alternatives like DocuSign or PandaDoc, breaking down the barrier to entry for businesses looking to scale globally without scaling their risk.

How to Automate Your Compliance Workflow with BoloSign

Knowing the risks of contract compliance is one thing, but actually fixing them is a whole different ball game. The good news? You don't need a massive legal department or an enterprise-level budget to build a compliance process that actually works. Modern tech puts powerful automation right at your fingertips, turning what used to be a chaotic manual mess into a simple, predictable workflow.

This is exactly where BoloSign comes in. We built our platform to solve the real-world compliance headaches that slow businesses down and leave them exposed to risk. Instead of chasing down signatures, digging through email chains for approvals, and manually tracking deadlines on a spreadsheet, you can manage the entire contract lifecycle from a single, secure hub.

From Creation to Execution Instantly

Strong compliance begins with a solid agreement. With BoloSign, you can instantly create, send, and sign PDFs using a library of pre-approved, compliant templates. This means every contract your team sends out already has the right legal clauses and protections built-in for your industry, whether it's a BAA for healthcare or an SLA for a logistics partner.

Approval workflows—often the biggest bottleneck—become completely automated. You can set up multi-step approval chains that send documents to the right people in the right order. No more guessing who needs to see the contract next; the system handles it for you while creating a clear, auditable trail of every sign-off.

AI-Powered Intelligence and Global Security

Beyond basic automation, BoloSign weaves intelligence directly into your workflow. Our AI contract review feature acts as a second set of eyes, automatically flagging risky or non-standard terms before an agreement ever goes out the door. For lean teams, this kind of proactive risk mitigation is a game-changer.

On top of that, every eSignature captured through BoloSign is secure, legally binding, and compliant with global standards like the ESIGN Act and eIDAS. This gives you the legal footing you need to operate with confidence in markets across the US, Canada, Australia, and the UAE.

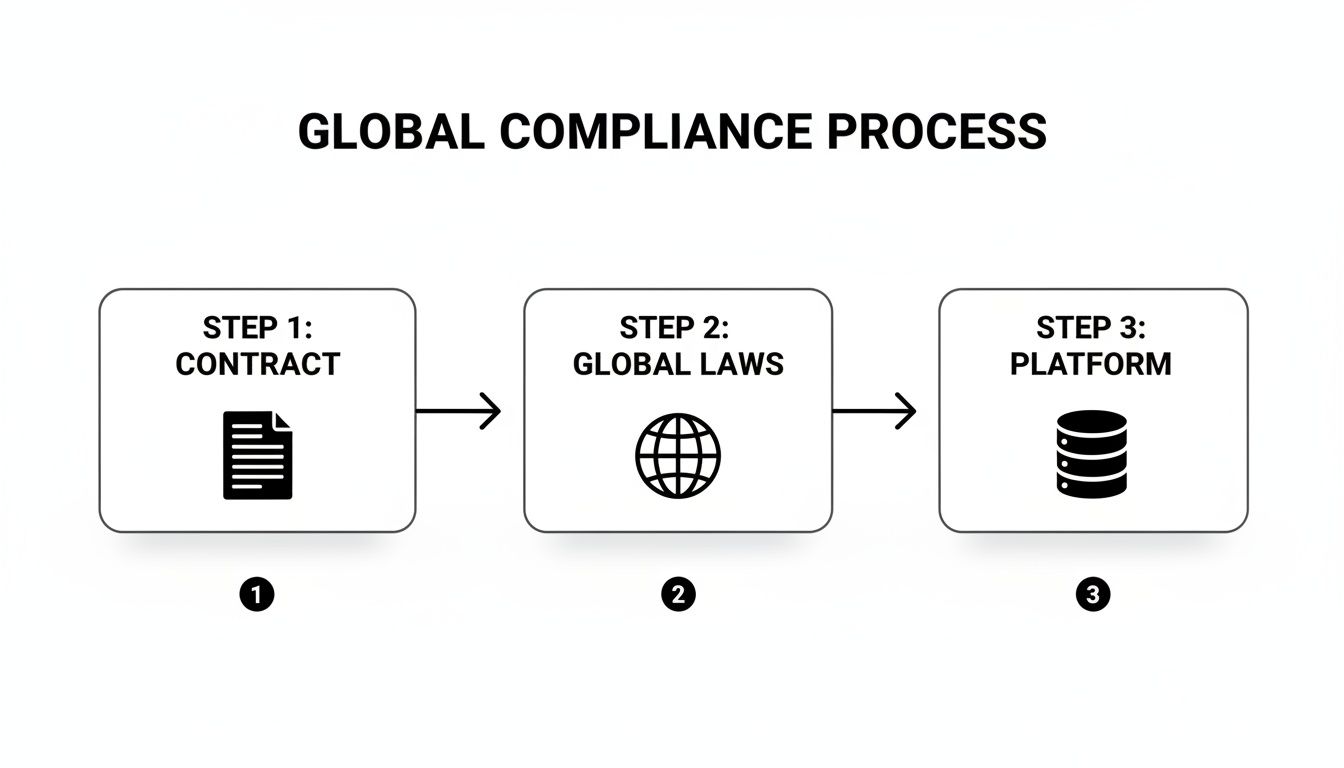

The infographic below shows how a platform like BoloSign connects your contracts to global laws within one unified system, centralizing your compliance efforts.

This visual really gets to the core benefit of automation: creating one source of truth where every agreement is managed against the regulations that matter.

Enterprise-Grade Compliance Made Affordable

For too long, powerful contract management tools were priced out of reach for most businesses. We're here to change that. BoloSign offers enterprise-grade contract automation and compliance features on a model that actually makes sense for growing companies.

We believe every business deserves access to tools that protect them from risk. That's why we offer unlimited documents, unlimited templates, and unlimited team members for one simple, fixed price.

This straightforward approach makes BoloSign up to 90% more affordable than per-envelope solutions like DocuSign or PandaDoc. You get total control over your contract compliance without ever worrying about surprise fees or usage limits. By bringing everything—from drafting and approvals to execution and auditing—under one roof, you create an effortless system of record. You can learn more about how this all fits together in our guide to CLM software.

Ready to see just how simple and affordable a fully automated compliance workflow can be? Experience the difference for yourself.

Common Questions About Contract Compliance

Here are a few quick, practical answers to some of the most common questions we hear about making contract compliance work for your business.

What Is the First Step to Improving Contract Compliance?

The single most critical step is getting all your contracts in one place. You can't manage what you can't see.

Centralizing your agreements into a single digital hub like BoloSign gives you the visibility you need to start tracking obligations, monitoring deadlines, and building a real contract automation strategy. It’s the foundation for everything else.

How Does an ESignature Solution Help with Compliance?

A secure eSignature platform is fundamental to modern compliance. It creates a legally binding, time-stamped audit trail for every agreement, proving exactly who signed, when they signed, and that the document hasn't been touched since.

This is crucial for meeting legal standards like the ESIGN Act and eIDAS, which validate the integrity of electronic records. It also makes it simple and secure to sign PDFs online, turning a potential compliance headache into a seamless part of your workflow.

Can Small Businesses Afford Contract Compliance Software?

Absolutely. Small businesses face the same risks as large enterprises but often have tighter budgets, so affordability is everything.

That's why BoloSign offers unlimited documents, templates, and users for one fixed price—often up to 90% more affordable than other solutions. This makes powerful compliance and AI contract review tools genuinely accessible to businesses of all sizes, so you can protect your operations without breaking the bank.

Ready to see how simple and affordable a fully compliant workflow can be? With BoloSign, you can create, send, and sign an unlimited number of agreements with features that support global standards like HIPAA, GDPR, and eIDAS.

Start your 7-day free trial today and experience effortless contract compliance firsthand.

Paresh Deshmukh

Co-Founder, BoloForms

9 Jan, 2026

Take a Look at Our Featured Articles

These articles will guide you on how to simplify office work, boost your efficiency, and concentrate on expanding your business.

Compare the best AI contract review tools for 2025. See features, benefits, and practical tips to implement them at scale. Explore BoloSign’s unified solution.

Paresh Deshmukh

Co-Founder, BoloSign

Learn if clickwrap agreements are legally binding, how they work, and key best practices for enforceability.

Paresh Deshmukh

Co-Founder, BoloSign

Ready to streamline your contract management with AI?

Contact Sales

AI assistant to draft, review, and eSign contracts on autopilot for fastest growing companies.

Email: support@boloforms.com

Sales Inquiry

AI assistant to draft, review, and eSign contracts on autopilot for fastest growing companies.

Email: support@boloforms.com

Company

Solutions

Resources

Legal & Security

Sales Inquiry